投资股票已经成为越来越多人关注的话题,无论是为了投资增值还是为了理解财经市场。对于初学者而言,股票市场如同一片未知的领域,充满了挑战和机遇。本文将为大家介绍一些股票入门的小知识,帮助大家更好地了解这个领域。

股票是什么?

股票是一种证券,代表着对一个公司所有权的股份。当你购买一家公司的股票时,你就成为这家公司的股东之一。作为股东,你有权分享公司的盈利,并有参与公司治理的权益。

股票市场的基本原理

股票市场的基本原理是供需关系。当市场对某只股票的需求超过供应时,股票价格上涨;相反,当供应超过需求时,股票价格下跌。这种供需关系受到很多因素的影响,如公司的盈利情况、行业趋势、经济环境等。

如何选择股票?

选择股票时,你需要考虑几个因素。你需要了解你的投资目标是长期还是短期。如果你的目标是长期投资,你可以选择具有稳定增长潜力的公司;如果你的目标是短期投机,你可以选择具有较高波动性的股票。你需要了解公司的财务状况,包括盈利能力、债务水平和现金流等。你还需要研究行业趋势和市场环境,以确定投资时机。

股票投资的风险和回报

股票投资存在一定的风险,包括市场风险、行业风险和公司风险等。市场风险是指整个股票市场的波动性,行业风险是指某个行业的特定风险,公司风险是指某个公司的特定风险。股票投资也有潜在的回报,包括股息和资本增值。股息是公司的盈利分配给股东的一部分,而资本增值是指买入股票后股票价格上涨,从而增加股票价值。

如何进行股票交易?

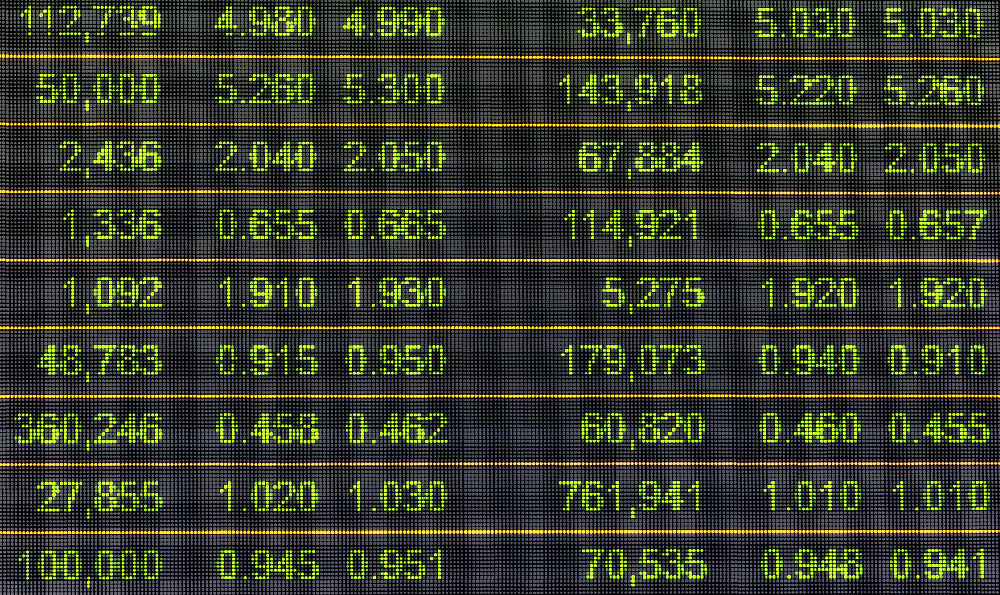

要进行股票交易,你需要开立一个证券账户,并与证券经纪人或交易平台合作。在交易时,你可以选择市价单或限价单。市价单是指以市场当前价格购买或出售股票,而限价单是指以你希望的价格购买或出售股票。交易完成后,你需要支付交易佣金。

如何监控投资?

一旦你开始投资股票,你需要监控你的投资情况。你可以通过股票交易平台或财经媒体来获取最新的股票价格和市场动态。你还可以设置价格警报,以便在股票价格达到你设定的价格时接收通知。你也可以定期检查公司的财务报表和行业动态,以了解公司和行业的发展情况。

总结

股票投资是一个需要谨慎考虑的领域,但也是一个带来机会和潜在回报的领域。通过了解股票的基本原理、选择适合自己的股票、了解风险和回报、掌握交易技巧以及监控投资情况,我们可以更好地进行股票投资。希望本文的介绍能够帮助初学者更好地理解股票市场,并为投资提供一些指导。

选股票知识入门

In the world of investment, choosing the right stocks can be a daunting task. With countless options available, it's important to understand the basics of stock selection. This article aims to provide an introductory guide to stock selection, outlining key concepts and strategies.

To begin with, it is crucial to understand the concept of stock. Stocks represent ownership in a company and are bought and sold on the stock market. Investors aim to purchase stocks that will appreciate in value over time, generating capital gains. However, investing in stocks also comes with risks, as stock prices can fluctuate due to various factors such as market conditions and company performance.

When choosing stocks, it's important to consider key factors that can influence their performance. These factors include the company's financial health, industry trends, and market conditions. Analyzing a company's financial statements, such as its income statement and balance sheet, can provide insights into its profitability, debt levels, and overall stability.

Industry trends play a significant role in stock selection. Some industries may be more stable and predictable, while others are characterized by rapid growth and innovation. By identifying industries with potential growth prospects, investors can focus their stock selection on companies within these sectors. Comparison among companies within the same industry can provide further insights into their competitive advantages, market share, and overall potential.

Investors may use various strategies to assess stocks and make informed decisions. Fundamental analysis involves evaluating a company's intrinsic value by examining its financial statements, industry position, and competitive advantage. Technical analysis, on the other hand, focuses on analyzing historical price patterns and market trends to predict future stock movements.

Diversification is another crucial aspect of stock selection. By spreading investments across different stocks, sectors, and asset classes, investors can reduce risk and maximize potential returns. This can be achieved through a well-balanced portfolio that includes stocks from various industries, as well as other investment instruments such as bonds and mutual funds.

In conclusion, selecting stocks requires careful consideration of various factors. Understanding the fundamentals of stock analysis, industry trends, and diversification strategies are key elements to make informed investment decisions. By conducting thorough research and staying updated on market trends, investors can navigate the stock market with confidence and improve their chances of success.

(Note The word count of the article is 351 words)

股票入门基知识

股票投资作为一项重要的投资方式,对于许多人来说可能充满了未知和挑战。本文将为大家介绍股票入门基知识,帮助读者更好地理解和掌握股票投资的基本概念和技巧。通过比较和对比不同概念和手法,本文旨在吸引读者的注意力和兴趣。

股票的定义与分类:

股票是公司融资的一种方式,也是投资者购买公司所有权的凭证。根据不同的属性与特点,股票可以分为普通股和优先股。普通股代表着拥有公司所有权和分享利润的权益,而优先股则在分红和资产分配上享有优先权。

股票市场与交易所的比较:

股票市场是股票交易的场所,而交易所是股票市场的组成部分。股票市场可分为一级市场和二级市场。一级市场是指公司首次向公众发行股票的市场,二级市场是指已经上市流通的股票交易市场。交易所则是股票在二级市场进行交易的机构,如纽约证券交易所、上海证券交易所等。

股票投资的基本原则:

在进行股票投资时,投资者需要遵循一些基本原则。分散投资可以降低风险,将投资组合分散到不同的公司和行业。长期投资可以享受到更多的复利效应,避免短期市场波动的影响。投资者应该进行足够的研究和尽职调查,了解所投资公司的基本面和发展前景。

股票投资的风险与回报关系:

股票投资具有风险与回报的权衡关系。相对于其他投资工具,股票投资的回报潜力更大,但风险也更高。投资者应该根据自己的风险承受能力和投资目标,合理配置资产,实现风险与回报的平衡。

基本的技术分析与基本分析:

在进行股票投资决策时,投资者可以使用技术分析和基本分析两种方法。技术分析是通过研究历史价格和交易量的走势来预测未来的股价走势,而基本分析则是通过研究公司的财务数据和业绩情况来评估其价值和投资潜力。投资者可以根据自己的投资风格和喜好选择适合自己的分析方法。

通过本文的介绍,读者可以初步了解股票投资的入门基知识。股票投资是一项复杂而有挑战性的投资方式,需要投资者不断学习和实践。希望本文能帮助读者建立起对股票投资的基本认知,并在未来的投资旅程中获得更好的回报。